Finance Theory

Options

Call Option Gives its owner the right to buy stock at a specified exercise or strike price on or before the maturity date

If the option can only be exercised at maturity it is conventionally known as a European call. Else if it can be exercised on or at any time before maturity it is called an American call

Put Option Gives the owner the right to sell stock at specified "write" price before the maturity date

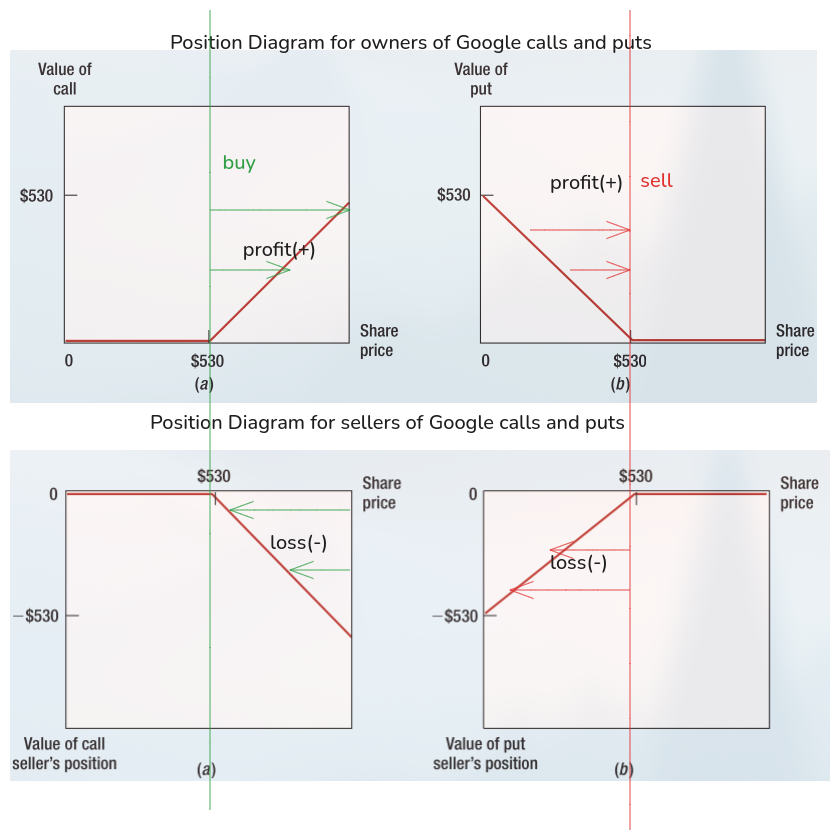

position diagrams

Consider an interaction between buyers and sellers of options

Owner refers to the guy who owns the call/put

Seller refers to the guy whom sells the call/put to a buyer. That is

- you promise to sell the stock at strike price to the buyer of the call should they exercise it

- you promise to buy the stock at strike price from the buyer of the put should they exercise it

Consider 2 ways in which the option owner gets a favorable position on their options

-

(a)

-

the option owner has a call with strike price $530

-

suppose the share price turns out to be more than $530

-

the owner has the right to buy the stock at a price($530) which is lower than the market price

-

the seller will then be forced to sell the stock at $530 which is lower than the market price

-

now suppose instead the stock price falls. In that case the owner simply will not exercise their call as they will be buying at a strike price higher than that of the market price

-

-

(b)

-

the option owner has a put with strike price $530

-

suppose the share price turns out to be less than $530

-

the owner has the right to sell the stock at a price($530) which is higher than the market price

-

the seller will then be forced to buy the stock at $530 which is higher than the market price

-

now suppose instead the stock price rises. In that case the owner simply will not exercise their put as they will be selling at a strike price lower than the market price.

-

Note that these are not necessarily profit diagrams because they do not account for the price the buyer/seller paid for the call/put. That is why are called position diagrams which only show payoffs at the option exercise only

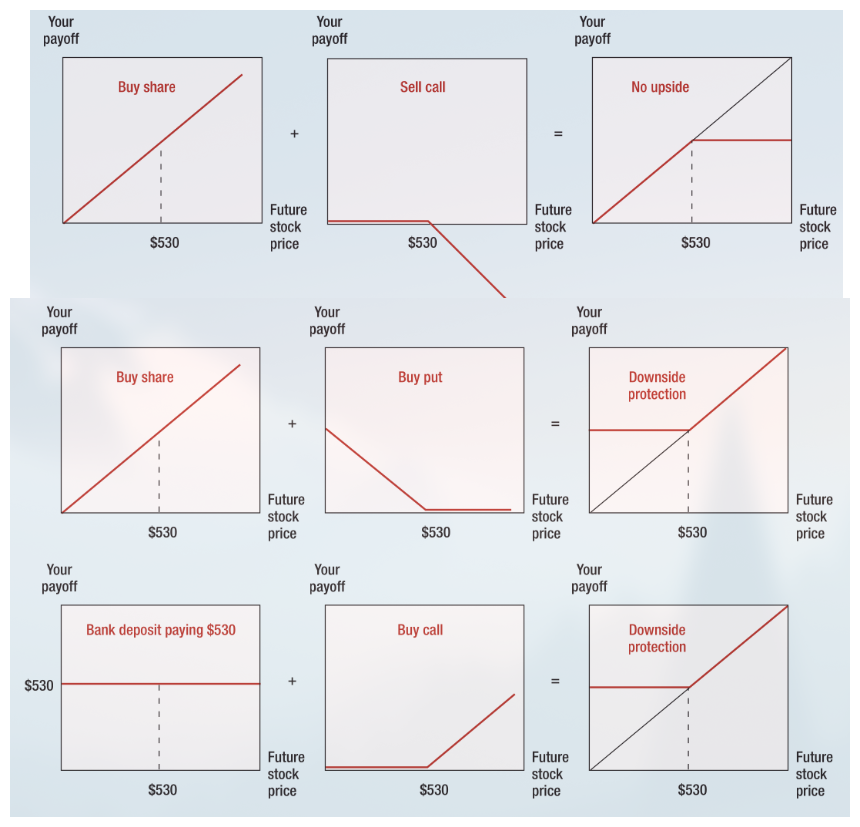

Option Strategies

Consider the following 3 strategies

- Buy share + Sell Call

- Say you bought a share at $530.

- Now because you don't account for the $530 paid for it in a payoff diagram it does not start from zero at S=$530.

- The value of your stock simply rises and falls together in 1 to 1 relationship with the market stock price as they just the same items.

- Then now you sell a call with strike price

. - On superposition you gain the no upside graph

- Buy Share + Buy Put

- follow similar logic as above

- Bank Deposit + Buy Call

- well unlike a stock whose values varies depending on the stock market your deposit remains at the same value at which you deposited(in this case $530) i.e independent stock price

- follow similar logic again and superimpose to get the downside protection graph